Investment Strategies for Young Professionals

- General

- Pgruchali Patil

“As a student at [ISB&M], I’ve had the opportunity to participate in diverse research projects that have shaped my academic journey.”

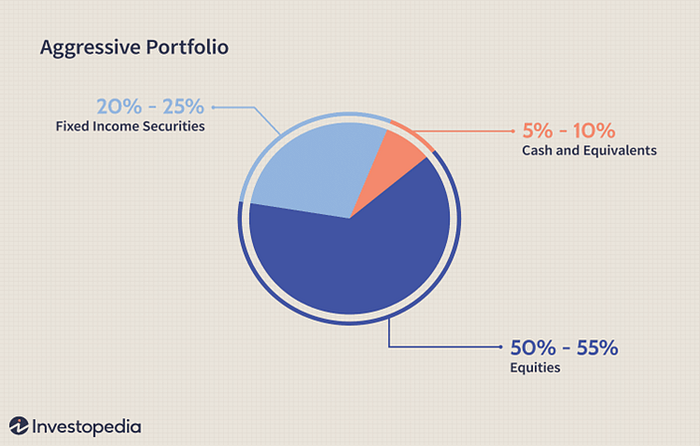

Illustration of an aggressive portfolio allocation. It shows the recommended breakdown of investments for an aggressive investor:

- Equities: 50–55% of the portfolio should be invested in equities (stocks).

- Fixed Income Securities: 20–25% should be allocated to fixed income securities (bonds).

- Cash and Equivalents: 5–10% should be kept in cash or cash equivalents (such as money market funds).

This aggressive portfolio strategy aims for higher returns but also comes with higher risk. It’s suitable for investors who are comfortable with market volatility and have a long-term investment horizon.

As a young professional, you have the unique advantage of time on your side. This allows you to take on higher-risk, potentially higher-reward investments that can significantly grow your wealth over the long term. Here are some effective strategies to consider:

1. Start Early and Invest Regularly:

· Power of Compounding: The earlier you start, the more time your investments have to grow through compounding.

· Systematic Investment Plan (SIP): Invest a fixed amount regularly, regardless of market fluctuations.

.

2. Diversify Your Portfolio:

· Asset Allocation: Spread your investments across different asset classes like stocks, bonds, real estate, and gold to reduce risk.

· Index Funds and ETFs: These offer diversification at a lower cost.

3. Utilize Tax-Advantaged Accounts:

· Retirement Accounts: Explore options like 401(k)s or IRAs to enjoy tax benefits.

· Tax-Deferred Investments: Consider investments that defer or reduce taxes.

4. Consider Equity Investments:

· Stocks: Offer the potential for high returns over the long term.

· Mutual Funds: Managed by professionals, they provide diversification and expertise.

Retirement Accounts

Contributing to retirement accounts such as 401(k)s or IRAs is essential. These accounts often come with tax advantages and, if employer-sponsored, may include matching contributions, which can significantly boost retirement savings over time.

Risk Management

Understanding personal risk tolerance is vital. Young professionals can typically afford to take on more risk, given their longer investment horizon. However, it’s important to assess personal comfort levels with market volatility and adjust investment choices accordingly.

Investing differs from trading in that investing is for the long-term, usually years or decades. Investing is one of the key strategies to building long-term wealth and financial security.

Key Terms;

Bonds are lower-risk and lower-return investments than stocks, which makes them an essential component of a balanced investment portfolio, especially for older or more conservative investors.

Stocks, each unit of which is called a share, represent ownership of a company. Stocks, owned either directly or through a mutual fund or ETF, will likely form the majority of most investor’s portfolios.

Written By : Pgruchali Patil

Student At ISB&M Bangalore