Understanding Financial Statements: A Guide for Beginners

- Finance

- Saandeep Kumar I K

Financial statements are the heartbeat of a company’s financial health. They provide a snapshot of a company’s financial position at a specific point in time and its performance over a particular period. For beginners, navigating through these documents can seem daunting, but with a basic understanding of their components and purpose, you’ll be well on your way to deciphering the financial story of any business.

The three primary financial statements are the Balance Sheet, the Income Statement, and the Cash Flow Statement. Each serves a unique purpose and offers different insights into a company’s financial activities.

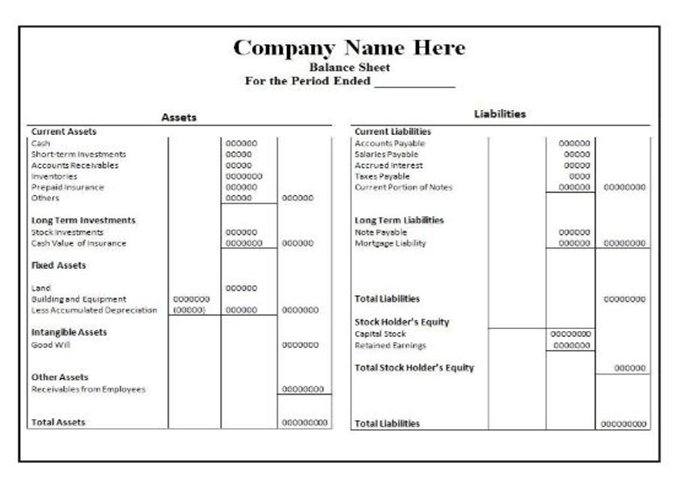

The Balance Sheet: A Snapshot of Financial Position

The balance sheet is like a photograph of a company’s financial condition at a specific moment, usually at the end of a quarter or fiscal year. It’s based on the accounting equation: Assets = Liabilities + Equity.

Assets are what the company owns, such as cash, inventory, and property. They are categorized into current assets (convertible to cash within a year) and non-current or long-term assets.

Liabilities are what the company owes, including loans, accounts payable, and accrued expenses. Like assets, liabilities are divided into current and long-term.

Equity represents the residual interest in the assets of the company after liabilities are subtracted. It’s the value that would be returned to shareholders if all assets were liquidated and all debts were paid off.

The balance sheet helps you understand the financial structure of a company, including its liquidity and solvency.

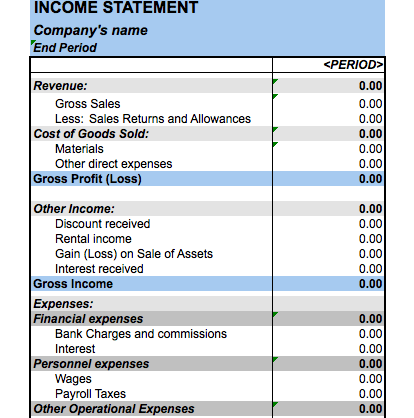

The Income Statement: Tracking Profitability

The income statement, also known as the profit and loss statement (P&L), shows a company’s financial performance over a specific period, such as a month, quarter, or year. It’s organized around the following elements:

Revenue is the income generated from the sale of goods and services before any expenses are deducted.

Cost of Goods Sold (COGS) includes the direct costs attributable to the production of the goods sold by the company.

Gross Profit is calculated by subtracting COGS from revenue.

Operating Expenses encompass selling, general, and administrative expenses (SG&A) and depreciation.

Operating Income is derived by subtracting operating expenses from gross profit.

Interest Expense and Taxes are then deducted to arrive at the Net Income, which is the bottom line and what the company has earned after all expenses.

The income statement is crucial for assessing a company’s profitability and efficiency in generating sales and managing expenses.

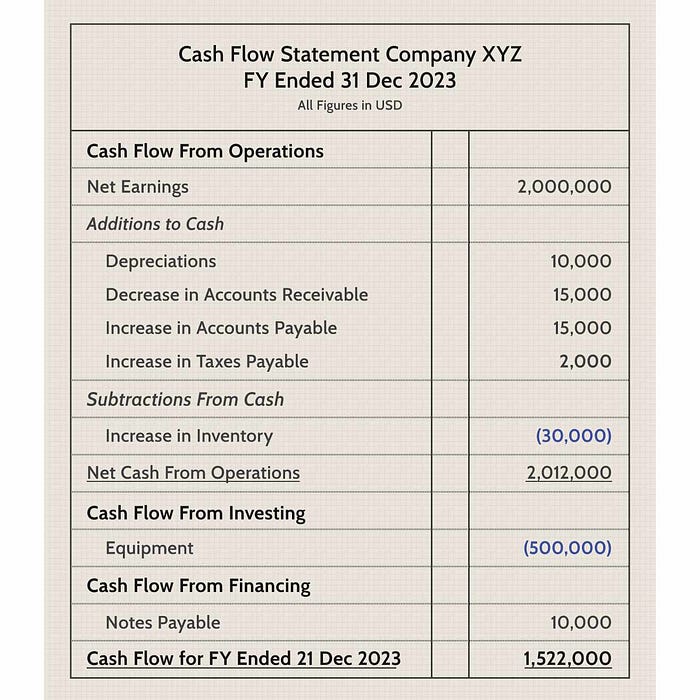

The Cash Flow Statement: Monitoring Cash Movements

The cash flow statement is a financial document that records the amount of cash and cash-equivalents entering and leaving a company. It’s divided into three main sections:

Operating Activities include the cash effects of transactions that enter into the determination of net income.

Investing Activities involve purchases and sales of long-term assets and investments.

Financing Activities encompass transactions that affect the company’s capital and debt structure, such as issuing equity, borrowing, or repaying debt.

The cash flow statement is vital for understanding a company’s liquidity and solvency and for spotting cash flow patterns that may not be apparent on the income statement.

Start with the Basics: Familiarize yourself with the key terms and concepts before diving into the statements.

Read Them Together: Analyze the financial statements in conjunction with one another to get a comprehensive view of the company’s financial health.

Look for Trends: Analyze statements from multiple periods to identify trends and patterns that can indicate the company’s direction.

Use Ratios: Employ financial ratios to compare different aspects of the company’s performance, such as profitability, liquidity, and solvency ratios.

Read the Notes: The footnotes to the financial statements often contain valuable information that can help you understand the numbers better.

Understanding financial statements is a skill that improves with practice. As a beginner, take the time to explore these documents, and don’t be afraid to ask questions or seek further clarification. With persistence and a willingness to learn, you’ll soon be able to confidently interpret the financial story of any company.